Source: http://www.theverge.com/2015/6/3/8719659/amazon-prime-air-drone-delivery-profit-free-shipping-small-items

Amazon is famous — perhaps infamous — for creating a huge core business, with brutal margins, that produces little to no profit. Yet it announced yesterday that it would roll out free shipping to all its customers on items that weigh 8 ounces or less with no minimum order size. At a glance, it seems like yet another move by Amazon to tighten its death grip on the $304 billion online shopping industry at the expense of the bottom line, but that might not be the case soon: if the company can manage to make its Prime Air drone delivery program a reality, delivering lightweight goods could actually become a weirdly profitable part of the business.

Granted, there are still many technological and regulatory hurdles Amazon will need to surmount before Prime Air takes flight, even taking into consideration the progress we’ve seen in the industry and from the FAA over the last year. But let’s set those obstacles aside for a second to consider an interesting hypothetical: in a world where the FAA trusts semi-autonomous drones to fly over populated cities, do the economics of drone delivery make any sense? An analysis from Tasha Keeney at investment firm Ark offers a compelling argument that drone delivery could provide a path to substantial profits.

Amazon is on track to generate roughly $60 billion in revenue across North America this year, and the average order size for two items is around $60, so Keeney make a rough estimate of 1 billion orders and 2 billion items shipped each year. Amazon founder and CEO Jeff Bezos has said that 86 percent of Amazon deliveries are the under 5-pound weight limit a commercial drone could reasonably carry. Keeney cuts that number down considerably, estimating just a quarter of orders will be both under 5 pounds and within a 10-mile range of a drone base station.

That works out to roughly 400 million packages a year eligible to be delivered by drone, a number that is likely to grow before Prime Air drones take flight. How much would it cost to put this program together? Keeney guesses $50 million on infrastructure for the Prime Air program to retrofit existing fulfillment centers with additional space, equipment, and software. The drones themselves, based on what Amazon has shown, are cheap quadcopters, costing around $1,000 to $3,000. Let’s start with 30 deliveries per drone per day, assuming they can’t operate at night or in bad weather, and each delivery takes roughly half an hour. It would take a fleet of 30,000 to 40,000 drones to move all that merchandise. Give them two batteries each at $200 a pop for a grand total of $80 million in equipment. That’s $150 million in overall capital expenditures, not a prohibitive expense for Amazon, which has billions in free cash flow.

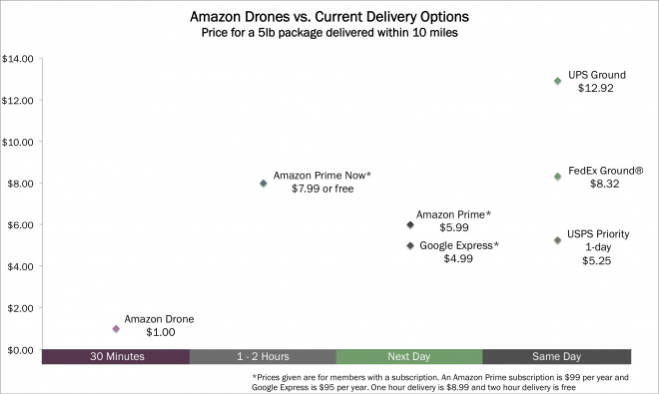

The real savings of drones, of course, is that unlike delivery trucks, they can operate without a human pilot. Keeney works on the assumption that even if the drones are allowed to fly without a human piloting them, there will need to be experienced operators who are keeping an eye on things, or helping with critical moments like landing in your front yard while avoiding the neighbor’s very agitated dog. Let’s say 6,000 drone minders at $50,000 a year, for labor costs of $300 million each year. She adds another $50 million each year for charging costs and fleet maintenance, and $350 million a year to deliver 400 million parcels is roughly 88 cents per package, which Keeney conservatively rounds up to $1 to simplify the comparison.

Keeney’s research shows that stacks up incredibly well when compared to the cost of traditional same day delivery for FedEx, USPS, Google Express, and Amazon. Based on these margins, Amazon would recoup its investment in Prime Air after one year and generate substantial profit thereafter. (No wonder Amazon is pursuing Prime Air so aggressively.)

Again, there are many assumptions here and a lot of conjecture, but the assumptions are reasonably conservative. Amazon wouldn’t offer any comment, and some drone industry experts were skeptical. “The economics are based on 400 million packages,” says Colin Snow. “Logistics operations have to ramp to full volume over time, so you’d have to bend investment and ROI accordingly — which Ark didn’t do in this analysis.” But that’s mainly a criticism of how quickly Ark believes the program would pay for itself, not an attack on the broader picture of how profitable it could be.

And while Keeney is calculating the per order cost with a 15 percent discount to get a nice round number of $1 per order, it’s not hard to imagine rapid drone delivery as the kind of thing people would pay a surcharge for. The program they rolled out yesterday will acclimate consumers to getting small items delivered for free, but with a reported wait of four to eight days. If you could have that package of Advil or missing ingredient delivered to your front lawn or rooftop in under an hour, it might be worth more than the sticker price.